Minnesota Lawmakers Seek To Repeal Illegal Drugs Tax Stamp Law

“Exhibiting up on the Division of Income to pay taxes in your unlawful drug gross sales might be not the most typical apply.”

By Peter Callaghan, MinnPost

A yr in the past, nobody within the Minnesota Legislature thought it was a good suggestion to require drug sellers to purchase tax stamps on their unlawful items.

A yr in the past, practically everybody within the Minnesota Legislature thought it was a good idea to repeal such a requirement that was a vestige of the Nineteen Eighties warfare on medication.

However a yr in the past, the repeal didn’t occur, caught up like lots of laws within the chaos of the closing hours of the 2024 session. Whereas fashionable, it was not included within the 1,400-plus-page Mega Omnibus bill that contained tons of of different payments.

So sponsors try once more.

“Our present statute expects that folks promoting unlawful medication buy stamps from the Division of Income upon the sale of their unlawful medication,” Rep. Jessica Hanson (DFL-Burnsville) instructed the Home Taxes Committee on Tuesday. “As I’m positive you possibly can think about, exhibiting up on the Division of Income to pay taxes in your unlawful drug gross sales might be not the most typical apply.”

The tax raises little or no cash, and gross sales look like from individuals who take into account them collectors gadgets greater than drug sellers. Whereas it might and has been utilized by county prosecutors, largely outdoors the Twin Cities metro space, the county attorneys affiliation has no place on the repeal, Hanson mentioned.

The bill’s cosponsor is the DFL taxes committee lead, Rep. Aisha Gomez of Minneapolis. And talking in assist was present Taxes Committee Chair Greg Davids of Preston who mentioned he would take into account transferring the invoice rapidly fairly than wait to have it included in a taxes omnibus later in session.

“After this invoice, I don’t suppose we’ll want these stamps anymore,” Davids mentioned whereas holding up a income stamp meant to be affixed to the medication when bought. “In order that they’re collectors gadgets, or quickly to be.”

The Senate model is sponsored by Sen. Clare Oumou Verbeten (DFL-St. Paul).

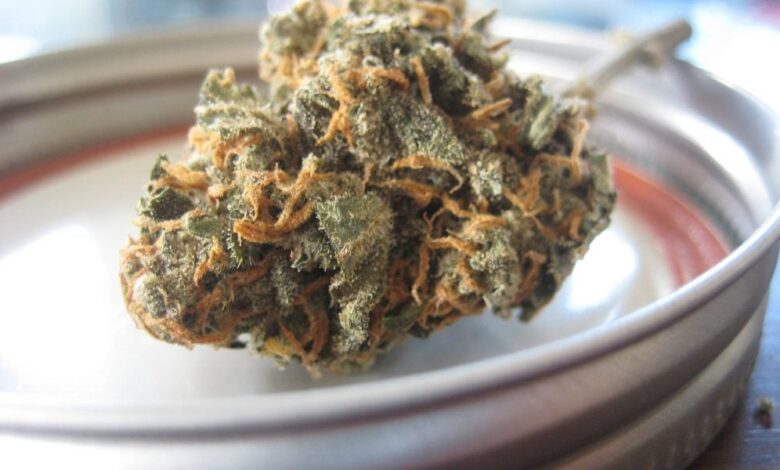

Home File 100 in 2023, which legalized hashish for leisure functions, has its personal taxation. However it would solely cowl the sale of authorized hashish. Underneath current law, somebody promoting hashish that’s outdoors the regulation of the state, similar to by way of the illicit market, would nonetheless be obligated to purchase stamps.

Underneath the regulation, sellers are anticipated to pay $3.50 per gram for hashish, $200 per gram for managed substances and $400 per dose for medication not bought by weight. Excellent news although: If a supplier has already paid an analogous tax in one other state, they will declare a credit score on their Minnesota levy.

The difficulty will get laughs when it’s introduced, as in who would ever anticipate a drug supplier to pay taxes on their medication earlier than they’re bought? But it surely seems the availability was meant to offer prosecutors an additional cost to file towards these accused of promoting unlawful medication. Whereas it doesn’t elevate a lot income, it has been used to cost sellers with the crime of failure to pay taxes.

Kurtis Hanna has made it a ardour venture to get the tax repealed. Presently a lobbyist engaged on hashish legalization points, Hanna has lengthy advocated for legalization after his personal expertise with an analogous regulation in Iowa. Sixteen years in the past, Hanna was arrested for possession of three ounces of marijuana. The prosecutors charged him with each possession of a Schedule I substance and failure to affix a tax stamp to that substance. The costs in Iowa have been finally dropped as a result of cops performed a search of Hanna’s automobile with out his permission and with no warrant.

Hanna’s analysis discovered that the federal authorities had a tax on unlawful medication from 1937 to 1969, when it was struck down by the U.S. Supreme Court docket. The legal reasoning was that it violated fifth Modification provisions towards self-incrimination.

However when the Minnesota Supreme Court docket had a similar case in 1988, it discovered that the unlawful drug tax was permitted.

Whereas it isn’t used lots in drug prosecutions, it does nonetheless occur, Hanna discovered by Minnesota court docket information.

He discovered 70 convictions for failure to pay the drug tax since 2012 involving 55 totally different prosecutions. He mentioned the circumstances are uncommon—round a dozen a yr, largely in larger Minnesota.

Whereas stamps could be ordered by mail, that requires a return handle. The Division of Income does present an nameless method to buy the stamps—at a window at its St. Paul headquarters utilizing money. However the division asks for discover so somebody could be accessible to deal with the transaction and have stamps prepared.